Production from the Bakken shale in the Williston Basin grew rapidly in the last decade, with horizontal drilling and fracking techniques pioneered by a number of operators.

As the formation matures, production growth will likely be dependent on improved pipeline capacity and the development of even more advanced techniques such as enhanced oil recovery (EOR).

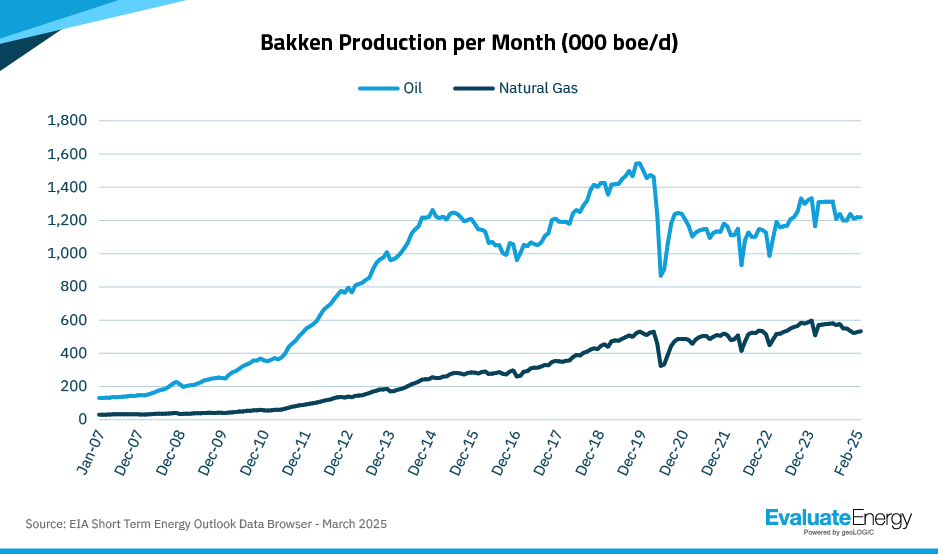

The reality is top tier inventory is depleting, and oil production is plateauing. Oil production peaked in 2019 and has not recovered to the same level since. Gas production peaked in late 2023 but has plateaued since then.

Operators are pursuing M&A opportunities, as well as new drilling technologies and well designs, to reduce costs and make lower-tier inventory profitable.

Content for this insight was researched using Evaluate Energy Documents.

The merger of Chord Energy and Enerplus last year created one of the largest players in the region. Chord’s plan is to keep oil production volumes of the merged assets flat on 2024 levels from 2025 thru 2027, with an annual capex of $1.4 billion.

“This outcome is a material improvement in capital efficiency and illustrates the quality and depth of our inventory,” said CEO Danny Brown in the firm’s third quarter results.

Vitesse Energy — which acquired Bakken producer Lucero Energy — says its strategy of M&A transactions is helping keep production flat with limited capex, supporting free cash flow.

TXO Energy — which closed its acquisition of Kaiser-Francis Oil Company and is pursuing a deal to purchase assets from Eagle Mountain Energy Partners — says its strategy of pursuing ‘accretive opportunities’ helps generate cash flow through efficient operations, which drives dividend distributions.

If and when Chevron closes its acquisition of Hess, the firm will operate 465,000 acres of inventory in the Bakken. The Hess assets in the Bakken saw net production rise seven per cent to 208,000 boe/d in the fourth quarter of 2024, primarily reflecting increased drilling and completion activity.

Chevron has not outlined the synergies it expects to achieve with Hess’ Bakken operations, but says it expects company-wide synergies to be as high as $1 billion before tax within a year of closing.

Similarly, ConocoPhillips is eyeing strong benefits from its acquisition of Marathon Oil’s Bakken assets and says the region will drive ‘solid’ free cash flow.

Refracs have been deployed in the Bakken to enhance production at existing wells.

Devon Energy is now carrying out refracs on Bakken assets acquired from Grayson Mill. ConocoPhillips also sees “significant upside potential” for refracs on its acquired Marathon acreage.

Some operators are also drilling wells where the wellbore follows a U-shaped trajectory rather than a straight line. These wells can re-enter old reservoirs, bypass faults, or access deeper formations, and in some cases match the performance of conventional wells.

Source: Click Here