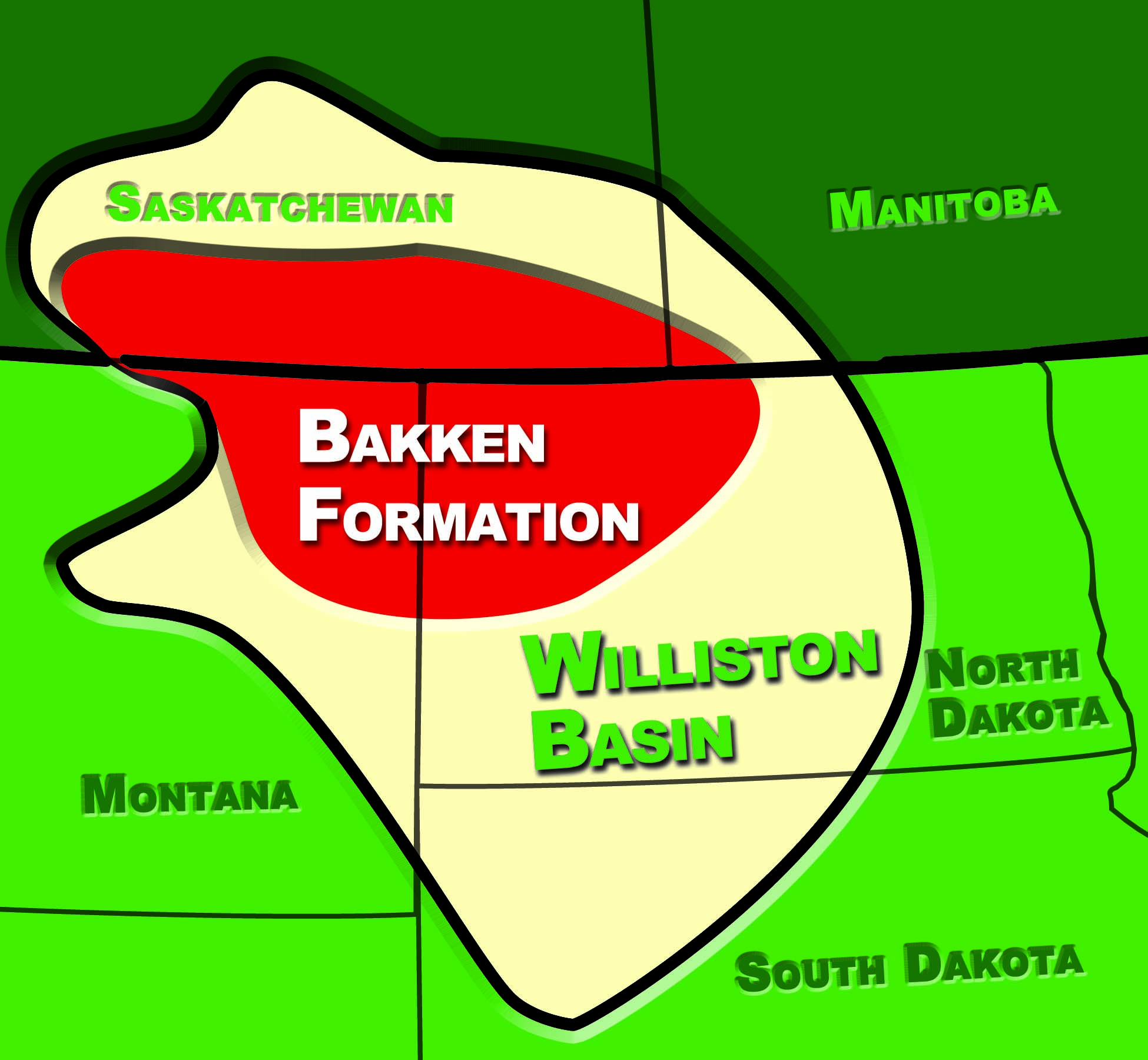

In July 2025, Bakken Formation oil production is forecasted to be 1.18 million barrels per day, with quarterly variations ranging from 1.15 million to 1.20 million barrels per day according to Energy News Beat. Drilling activity is at a five year low.

with rig counts at 35 due to high breakeven costs. Chevron finalized its acquisition of Hess assets, including those in the Bakken region, as part of a broader deal.

-

Production:The Bakken region is expected to maintain a stable production level of 1.18 million b/d in 2025, with minor quarterly fluctuations.

-

Drilling Activity:Drilling activity is significantly reduced, with rig counts reaching a five-year low, indicating a slowdown in new well completions.

-

Chevron-Hess Deal:Chevron’s acquisition of Hess includes Bakken assets, expanding Chevron’s global portfolio.

-

High Breakeven Costs:High breakeven costs ($60-$70 per barrel) are a major factor influencing the slowdown in drilling activity and production, making the Bakken formation sensitive to oil price fluctuations.

-

Other News:L&T is building India’s largest green hydrogen plant for IOCL, and BASF has completed the first acrylics units at its Zhanjiang Verbund site.

Chevron acquired 463,000 net acres in the Bakken from Hess. As Hess was a major producer. Chevron will issue approximately 301 million shares to Hess shareholders under the agreement, with a 1.0250 CVX-for-HES share exchange ratio.

Chevron’s deal with Hess could also mean competition for oil companies such as Continental Resources. Continental Resources holds 753,000 net acres in the Bakken Region making them the largest leaseholder and producer. However with ConocoPhillips acquiring Marathon Oil, they are now at 1,143,000 net unconventional acres. Marathon previously held approximately 390,000 net acres. Now making ConocoPhillips the largest leaseholder.